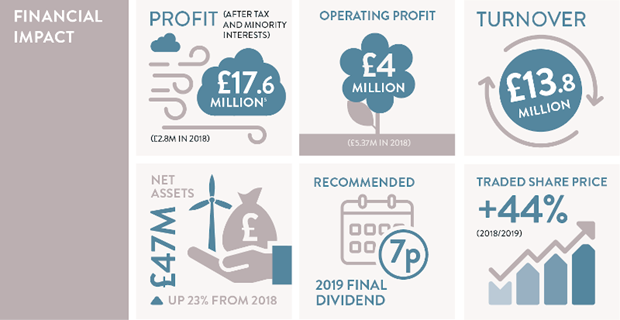

Today, our 2019 Annual Report is released, reporting a profit of £17.6 million including gains from the sale of two operational wind farms in February 2019. £12.3 million of these gains have been committed to fund the construction of three new renewable energy projects – a wind farm site and hydro project in Scotland and the UK’s first deep geothermal power plant in Cornwall.

Our portfolio of wind and hydro projects generated 166,734MWh of electricity in 2019, enough to power all the homes in a city the size of Worcester1. Together, the projects delivered over 75,000 tonnes of CO2 emissions reductions2.

Matthew Clayton, Managing Director at Thrive Renewables, said:

“As we cautiously start to emerge from the current crisis, the UK faces the dual challenges of rebuilding the economy and reducing carbon emissions. Developing and building new renewable energy capacity will reduce bills, create high quality skilled jobs and unleash investment in a green economic recovery.”

“Thrive is perfectly placed to help the UK ‘build back better’, bringing together impact investors, large and small, to deliver the next wave of clean energy projects. We believe impact investors will move quickly as they see the potential of renewables to underpin a totally transformed clean, smart energy system, fit for the future.”

Shareholders received a 40p per share interim dividend in April 2019 following the sale of the wind farms and a 7p final dividend in July 2019. A 7p per share annual dividend is recommended to be paid in July 2020, reflecting positive performance of the operational portfolio.

Thrive Renewables is marking its 25th anniversary this year, having invested in a total of 25 wind, hydro, solar and renewable heat projects, the majority of which it still owns and operates. Chair of the Board, Simon Roberts, said:

“Thrive’s approach of providing individuals with opportunities to make direct investments in renewable energy has never been more relevant. Particularly as the world’s financial sector wakes up to the material risk of carbon-intensive business as usual.”

Over the last 25 years, Thrive has paid a total of 96.2p per share in dividends. Shares have appreciated in value from £1.30 to £2.233 over the same period. The average annual return for shareholders joining Thrive over the last 25 years from dividends and capital appreciation is 7%4. Thrive’s market capitalisation is now over £50 million6.

Looking forward, Thrive Renewables has the following immediate priorities:

- Progress the three new renewable investments to successful commissioning

- Deliver additional opportunities for individuals to invest directly in the transition to a cleaner, smarter energy system for the UK via investments in new solar, wind and hydro projects

- Support net zero ambitions of businesses, local authorities and other organisations by enabling them to develop clean energy projects

- Ensure the existing portfolio generates as much power and impact as possible and exploring life extension of existing assets where relevant

- Identify opportunities to co-locate additional renewable capacity and battery storage at existing sites

Thrive’s voluntary Community Benefit Programme awarded grants totalling over £30,000 in 2019 to improve energy efficiency in shared buildings, such as youth centres and village halls, close to its sites. Recipients report improved warmth, comfort and accessibility, and expect to see lower running costs. In 2020, the company has already allocated £24,000 to provide emergency grants to local grassroots community projects supporting individuals and families struggling due to the Covid-19 crisis.

[1] Calculated using the most recent statistics from the Department of Business, Energy and Industrial Strategy (BEIS) showing that annual UK average domestic household consumption is 3,781kWh, www.renewableuk.com/page/UKWEDExplained. Population of Worcester 103,769.

[2] Calculated using most recent data on the carbon intensity of the UK electricity grid multiplied by our own electricity generation. www.renewableuk.com/page/UKWEDExplainded

[3] Based on the latest traded price on the secondary market as at 27th May 2020.

[4] 7% annualised return is calculated from dividends paid and using the latest traded share value on the secondary market. The return is averaged for shareholders who have purchased shares at different times by using share values for each new share issue.

[5] Includes £15.4m gain on sale of two wind farms

[6] Number of shares in issue multiplied by the latest traded price on the secondary market as at 27th May 2020.