Thrive Renewables exists to enable individuals to invest in sustainable energy. The Directors of the company are proud to have a very wide shareholder group. This gives us a particular responsibility to provide all our shareholders with an indication of the value of the company – the Directors’ Recommended Share Price (DRSP).

We evaluate the Directors’ Recommended Share Price when material events occur. In this context a material event is an occurrence (or combination of events) which has an impact on the value of Thrive Renewables. In February 2017 we provided an update on a number of factors which had had both positive and negative impacts on the value of Thrive Renewables. In our most recent review of the Company’s value, we have identified a range of factors which combined have a positive impact.

Life extension at Haverigg II

We have agreed extended lease terms with the landlord at Haverigg II in Cumbria. Haverigg II is a pioneering wind farm, built as part of the first wave of wind power in the UK, and in conjunction with a local community energy group. This is our oldest site, which this month enters its third decade of generation. Having extended the lease duration, we can now include an additional 5 years of operation and therefore financial contribution from the site.

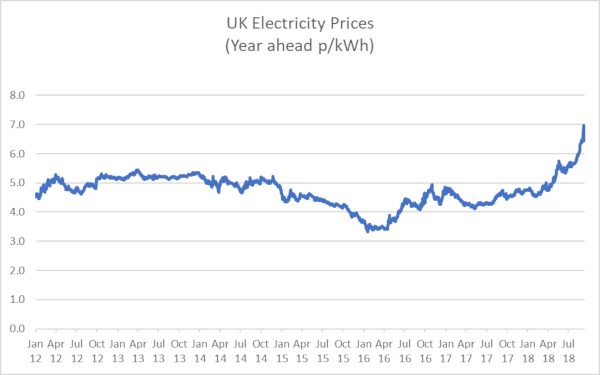

An increase in UK wholesale electricity prices

The chart above illustrates the movement of UK wholesale electricity prices. The negative impact on the Company’s value of the reduction in electricity prices experienced since 2014 has been offset by the growth in our portfolio. Since early 2016, electricity prices have been steadily increasing, with rapid uplift throughout the summer months. Whilst there are a vast range of factors which influence energy prices, the following combination of factors have had a material impact over the course of 2018:

- oil prices (and consequently natural gas prices) increasing,

- £ weakening in the currency markets relative to € and $, making imported fossil fuels and electricity (via the interconnectors) more expensive,

- Following shortages in the availability of natural gas earlier this year, questions remain about the adequacy of supply for the coming winter months.

Despite the long term projections of energy prices stabilising (helped by a growing contribution of renewables) electricity prices in the immediate years ahead are expected to increase. This provides Thrive with the opportunity to benefit from higher prices for the electricity it generates. Approximately 50% of Thrive revenue comprises government backed and inflation linked support. The other 50% is generated via the wholesale energy market. We manage our exposure to market price volatility by putting in place a mixture of short and long term price agreements with our customers for months, seasons and years ahead.

Embedded benefits

To date our operational projects have been able to access a range of minor revenue streams which in combination the industry refers to as ‘Embedded Benefits’. These revenue streams are site specific and can contribute up to 5% of a project’s revenues. The payments encompass a number of elements to support smaller, decentralised electricity producers, such as incentives for generating at peak times. As the mix of sources of generation changes, the national policies determining these benefits are being reviewed. Whilst the various consultations are ongoing, in our projection of future cashflows we have now taken a more conservative view of the future contribution of Embedded Benefits to reflect the changes widely expected by the industry. This change has had a marginally negative impact on the value of the company.

Mezzanine finance

We have been able to put the £10 million raised in the Thrive Renewables plc Bond issue to work faster than we had forecast. The majority of the money raised has been deployed as bridging loans to plug funding gaps, contributing to the construction of two new wind farms in Scotland and providing communities with access to capital to purchase renewable energy projects. The interest generated by the rapid deployment of the bond money has had a positive impact on Thrive’s financial performance.

Discount rate

The DRSP is calculated using projections of the cash our existing portfolio of renewable energy projects and investments will generate over the long term. To derive a value today for future cash flows, we apply a discount rate. You can find more information on the discount rate here. The appropriate discount rate to use is largely driven by the cost of our capital. This is calculated by combining the cost of the bank debt and bonds with our target shareholder returns.

We have successfully raised capital via the Thrive Renewables and Thrive Renewables (Buchan) bond issues, and renegotiated other debt terms (taking advantage of current competitive rates available) enabling us to lower our cost of debt. So the discount rate we apply has been reduced, resulting in a higher valuation for the Company.

In addition, we are observing a significant number of transactions where operational renewable energy projects are being acquired by both pension and infrastructure funds and funds set up with a view to delivering inflation linked yield. We have received valuations of some of our operational projects from leading infrastructure players. This provides us with a helpful benchmark of the value of our operational projects and consequently comfort in the value of the Company upon which the DRSP is calculated.

Impact on the Directors Recommended Share Price

The combination of the factors set out above result in a DRSP of £2.60, a 11% increase on the previous DRSP of £2.35.