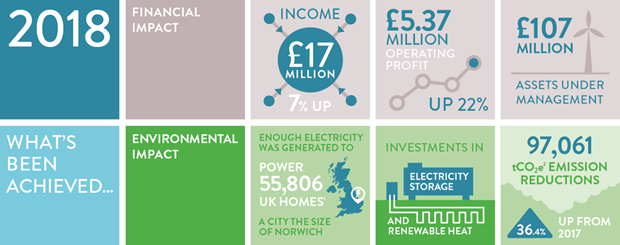

Operating profits in Thrive Renewables plc continued to grow in 2018 with a record profitability of £5.37 million - a year on year increase of 22%. We now have £117 million assets under management. In 2018 we were invested in 21 wind, solar and hydro sites, the majority of which we own and operate. We made new investments in renewable heat for retirement homes and battery storage solutions to improve flexibility on the grid and provide businesses with less carbon intensive power at lower prices.

Our positive environmental impact also increased by over a third when measured in CO2 emission reductions – mitigating the entire annual carbon footprint of 7,760 people3 in total. Last year we produced enough clean electricity to power all the households in a city the size of Norwich.

“Thrive shareholders and bondholders should be proud of the part they are playing in the transition to a cleaner, smarter energy system. Their pioneering investment enables us to continue to directly address the urgent challenges of energy decarbonisation with smart renewable energy systems.” Matthew Clayton, Managing Director, Thrive Renewables.

The sale of two wind farms early in 2019 led to a 40p per share interim dividend for shareholders in April, as well as £11 million released to invest in new clean energy projects. The Directors are recommending a 7p per share final dividend this year, subject to shareholder approval, reflecting an increase in profitability with new windfarms and other investments coming on stream and a decrease in debt as other projects mature.

“Our shareholders are investing for the long term. Investment in infrastructure like renewable power involves very high costs at the beginning, which are recouped gradually over their 25 year life span. The sale of the two wind farms this year demonstrates the high value that these type of assets are now attracting, and gives us confidence in the value of our existing portfolio and for investment in the future.” Matthew Clayton, Managing Director, Thrive Renewables.

Renewable power also brings advantages to host communities. Last year Thrive contributed £1.3 million4 to local economies . Our Community Benefit Programme awarded grants of over £30,000 to improve warmth and comfort in shared buildings such as youth centres and village halls close to our sites.

“We are poised now to enter a new phase of growth as the renewables industry takes its place as a major player in keeping the lights on for UK plc. Business models are changing to reflect new opportunities from the rapid decarbonisation of energy and transport, improvements in energy storage technology and grid flexibility and reductions in government support. Although the challenges posed by climate change are massive, we know how to transition to a cleaner, more sustainable way of life for us all and with the right policies in place nationally and internationally, it can be achieved." Matthew Clayton, Managing Director, Thrive Renewables.