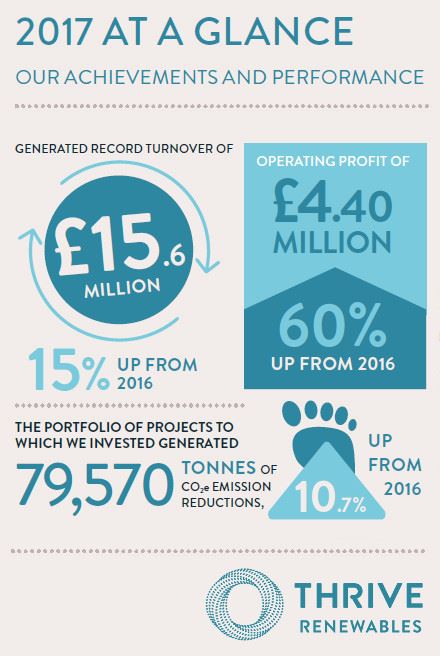

Thrive Renewables today announces a record turnover of £15.6 million in 2017, up 15% on 2016, and a 28% growth in generation capacity to 104.9MW from 21 renewables projects across the UK. A combination of Thrive’s own equity and money raised by its bond funded five investments in renewables projects over the year.

During 2017, Thrive Renewables:

- Raised nearly £10 million from 940 investors via the Thrive Renewables plc bond.

- Completed construction of two new onshore wind energy projects totalling 10.6MW.

- Created the Thrive Community Energy Funding Bridge, investing £11.4m in three projects, enabling the communities to buy renewable energy projects from large infrastructure owners.

“We believe in a clean, smart energy system that is powered by the investment of many. Our mission is to power the transition to a sustainable energy future by helping people meaningfully connect with and invest in clean energy projects,” says Matthew Clayton, Managing Director at Thrive Renewables.

“We play an active and committed role in the clean energy movement and work with a growing community of people and businesses who are dedicated to making change happen. We share our knowledge and insight to catalyse change and develop new innovative ways of funding renewables as the market evolves and changes.”

DELIVERING IMPACT IN 2017

Widening ownership of renewables

Thrive Renewables plc bond offer successfully closed in March 2017 having raised £9.96 million. Over 900 individuals invested in the bond in addition to impact investment institutions and foundations. A total of 669 new individuals joined Thrive’s community of investors via the bond.

Investing in new renewable capacity

Thrive Renewables contributed to construction and commissioning of 10.6MW of new onshore wind capacity in 2017. The company delivered 6MW through Drumduff wind farm in West Lothian, Scotland, through a joint venture with GreenPower (International) Ltd. It also provided a £1.48m mezzanine loan facility that contributed to the funding of Brotherton Wind Farm, a 4.6MW onshore wind project in Aberdeenshire, Scotland.

“One of our new wind projects, Drumduff, is particularly satisfying; it sits on the site of a ‘retired’ open cast coal mine. It’s difficult to think of a more appropriate and optimistic symbol of how we use investor’s money to directly transform the country’s energy system,” says Matthew.

Innovative community funding model

In 2017, Thrive supported three communities with a total £11.4 million investment: a £1.7m funding bridge to a Community Interest Company that owns the Sheriffhales 3.174MWp solar PV farm in Shropshire, a £7.4m funding bridge to Mean Moor Community Wind Farm Limited that owns a 6.9MW wind farm in Cumbria, and £2.3m funding bridge for the purchase of the 2.4MW Brockholes wind farm located in Scottish Borders.

Thrive has been able to use its capital flexibly to allow the migration of assets from commercial to community ownership. The new innovative funding model is designed to provide communities with the expertise, funding and certainty required to acquire operational renewable energy projects. It then provides the communities with the necessary time to raise the funds.

“The innovative concept of the Community Energy Bridge brings power back into the hands of the community, and we want to provide funding and technical support to more communities helping them to invest in power produced locally,” says Matthew.

FUTURE AMBITIONS

By 2020, Thrive has pledged to:

- Deliver renewable energy projects in a subsidy free world.

- Grow the investor base to 10,000, combining direct investment and funds facilitated by the Community Energy Funding Bridge.

- Invest into a portfolio of sustainable energy projects that deliver over 100,000 tCO2e of greenhouse gas emission reductions per annum.

Business strategy

Thrive will pursue a focused business strategy to deliver impact in the subsidy free context, focusing on three core areas:

Community Energy Funding Bridge

Many commercial players are looking to sell operational renewable energy projects to market. Thrive will continue to work with communities that have the ambition of owning renewable energy assets and provide funding bridges and expertise to facilitate the ownership transition.

Private wire generation

Thrive is working on securing more sites for supporting private wire generation at industrially-sited generation sites, such as its existing projects in Dunfermline, Eye and March.

Repowering mature assets

Thrive operates projects such as Haverigg II and Beochlich that are entering their third decade of generation. It will continue with the preparatory work on repowering (replacing the existing generation assets with new equipment) with a view to extending the life of the projects. The repowering of sites can help support the subsidy-free future, as cost savings can be achieved relative to a new site by utilising existing infrastructure, such as the grid connections.

“Thrive intends to be at the forefront of demonstrating that subsidy-free renewable electricity generation can work in the UK. We are focused on private wire opportunities and repowering of existing sites, as well as offering the Thrive Community Energy Funding Bridge to communities, so broadening ownership of renewable energy and making local assets more accessible for individuals,” says Matthew.

Subsidy-free

While Thrive’s existing portfolio delivers financial impact from Feed in Tariff and Renewables Obligation subsidies, the future for new projects looks very different. The near elimination of financial support and significant planning constraints imposed on new onshore developments in England have largely put paid to the standard business model of the last 20 years.

In the future, Thrive believes that new onshore renewable energy projects will only be viable if they are more actively part of the local electricity system, perhaps combining with low cost storage, smarter and more flexible demand management, private wire, and/or peer-to-peer trading.

Thrive intends to be at the forefront of UK renewables development by demonstrating that subsidy-free can work and exploring opportunities to invest in both battery storage and demand side management flexibility services.