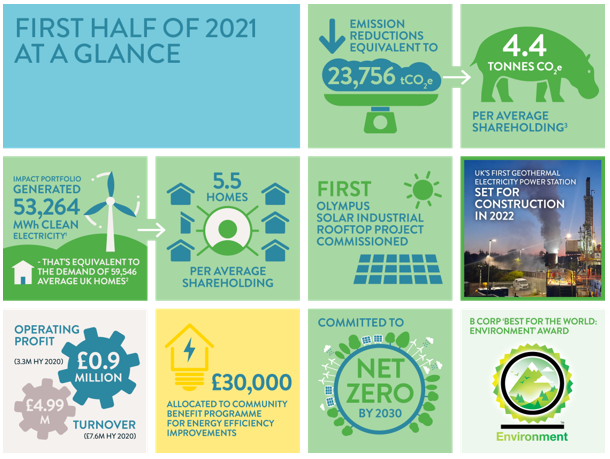

Thrive is continuing to have a positive impact on the planet – generating 53,264 MWh of clean electricity and delivering emissions reductions equivalent to 23,756 tCO2e in the first half of 2021 through our portfolio of wind, and hydro-electricity projects.

Due to the weather conditions during the first half of the year – Q2 2021 was one of the least windy on record – and also essential maintenance on some of our larger projects, there was a year-on-year reduction in the amount of electricity we generated.

Because of this, we have also reported lower financial results compared to the same period last year, with a half year operating profit of £0.9m on a turnover of £4.99m. Full details of Thrive’s financial performance and impact in 2020 can be downloaded via our Annual Report.

We are continuing to make the planned investment to our current portfolio and expect to see growth in the second half of the year.

There has been good progress in the development, construction and commissioning of our new battery storage, geothermal and industrial solar rooftop investments during H1. In particular, the United Downs site in Cornwall has produced geothermal steam at 175°C, while high levels of lithium have been found in its geothermal waters – showing huge potential to supply electric vehicle battery manufacture.

“We’re investing in the future of the UK energy system. As well as onshore wind, still the cheapest source of new electricity generation, our clean energy projects now encompass solar, hydro and sources of baseload renewable generation like geothermal heat and electricity. Flexibility is required to balance out the variability of wind and solar, so we are also investing in battery storage. Funding and operating a more diverse portfolio mitigates risk, enhances resilience and enables us to access new revenue streams. Addressing the climate crisis is fundamental to the whole organisation and we are proud to have taken more steps forward in achieving this, not only supporting local communities through our £30k Community Benefit Programme, but in announcing our own plans to achieve net zero emissions by 2030.” - Matthew Clayton, Managing Director, Thrive Renewables

Shareholders received a final dividend of 7p per share for 2020, which was paid in July 2021. We also successfully repaid the Thrive Renewables (Buchan) bond in July, where investments were used to fund two wind turbines at the Auchtygills and Clayfords farms in Aberdeenshire. Please note that past performance cannot be relied on as a guide to future returns.

In addition to reducing carbon emissions through our 20 renewable energy investments across the UK, we continue to have a positive impact both socially and environmentally. We recently announced our commitment to achieving net zero by 2030 as part of B Corp’s Climate Collective, while we were also featured on B Corp’s ‘Best for the World – Environment’ list, which saw us score within the top 5% of all global B Corps based on our commitment to reducing our footprint.

In July, we launched round five of our Community Benefit Programme in conjunction with the Centre for Sustainable Energy, providing grants for energy efficiency and sustainability improvements for community buildings close to our clean energy projects.

[1] Impact portfolio describes the electricity generation adjusted for Thrive’s proportion of ownership plus the generation from projects which Thrive has provided the majority of finance by way of loan and community energy funding bridge.

[2] 3.578MWh p.a. electricity demand of average UK home (renewableuk.com).

[3] RenewableUK uses BEIS’s “all fossil fuels” emissions statistic of 446 tonnes of carbon dioxide per GWh of electricity supplied in the Digest of UK Energy. Average Thrive shareholding of 4,190 shares.